The Cash Flow Quadrant – Robert Kiyosaki

Book Notes and Takeaways via Duncan Kelm

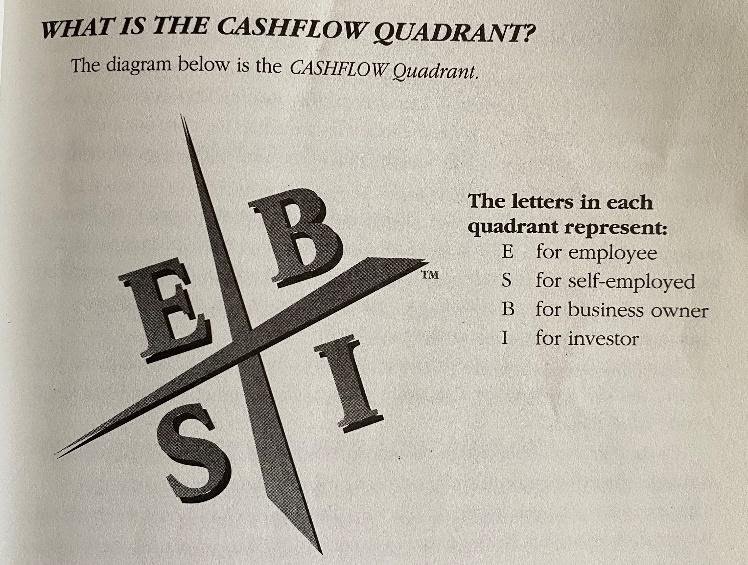

The Cash Flow Quadrant (CF4) is broken up into four different areas

- E = Employee || works for the system

- S = Self Employed || is the system

- B = Business Owner || creates & controls the system

- I = Investor || invests money into the system

A college education is important for traditional professions, but not always how great wealth is created

Higher education can be a drawback because you are trained to think one way

It’s not important what we “do” work wise, but how we generate income

Most people find themselves on the left side of the quadrant their whole lives

- On the left, there are few legal tax breaks, however on the right side, there are tax breaks abound

It is foolish to spend your life working for money and at the same time pretending money is not important

- Life is more important than money, but money is important for supporting life

What is important in life

- Having lots of time to raise kids

- Having money to donate to charities and projects

- Bringing jobs and financial stability to your community

- Time and money to take care of health

- Being able to travel the world with family

Time is the great equalizer, building wealth on the right side of the quadrant frees up time to do all the things you can’t if you are tied to a job

As we grow older and gain different experiences, our interests will often change

- Young people out of school are often happy to get a job, but years later feel trapped and forced to follow the corporate path

With the right side of quadrant can come fear

- For most, when the fear of losing money and failing becomes too painful inside, many choose to seek the security of working for someone else – there is another path where instead you should use the fear and pain to seek freedom

Changing from a quadrant is often a change at the core of who you are and how you think

- Changing quadrants is often a life-changing experience

Employees

- E’s seek security and often are concerned about the benefits

- When it comes to money and jobs there are many people who simply hate the feeling of fear that comes with economic uncertainty

- E’s want their benefits defined in a manner they easily understand

- Healthcare

- Pension

- 401K

Self-Employed

- SE want to be their own boss and “do their own thing”

- SE do not like having the amount of money they earn dictated by someone else or by a group of people who might not work as hard as they do

- SE tend to work extremely hard and rarely have freedom when it comes to their time

- They rarely trust others to do what they can do and often take control of situations rather than delegating

- Likely the hardest quadrant of the four

- This group is often made of well-educated professionals

- Doctors

- Lawyers

- CPAs

- SEs are often hardcore perfectionists and often want to do things exceptionally well

- For this group money is generally not the most important thing, independence and freedom to do things their own way is much more important and highly valued

- Also, being respected as an “expert” is extremely important to them

Business Owner

- Bs surround themselves with smart people from all four categories

- Unlike SEs they delegate work because they understand that is the best way to scale and also free up their time

- Why do it yourself, when someone else can do it for you, and do it better?

- Bs spend their time thinking

- Thinking is the hardest work there is. That is why so few people engage in starting and running a business

- Leadership is the willingness to bring out the best in people and is a trait of Bs

- Technical skills of business can be easy, the hard part of owning a business is working with people

- An SE owns a job, a B owns a system and then hires competent people to operate the system

- To be successful as a B requires

- Ownership or control of systems

- The ability to lead people

- Starting with a good control system lowers your risk

- For SEs to become Bs, they need to convert who they are and what they know into a system

- In moving to the B quadrant, the goal is to own a system and have others work that system for you

Investor

- Goal is to make money with money

- Full time Is do not have to work because their investments work for them

- Is invest in Bs

- Is borrow two things

- Other people’s time (OPT)

- Other people’s money (OPM)

- Both OPT and OPM are found on the right side of the quadrant

- Most wealthy people receive at least 70 percent of their income from investments

- I quadrant represents a person whose retirement income comes from investments made during working years

The definition of wealth is: the number of days you can survive without physically working and maintain your standard of living

- Wealth is measured in time, not dollars

The reason the rich often get richer is because they can make millions and legally not pay taxes on that money

- This is because they make money with assets not with income

- Assets are much more favorable than income in regards to taxation

More people aren’t investors because they choose to spend their money now versus invest, and most people cannot deal with the uncertainty and the fear involved in making investments

There are four broad categories of investors

- People who are risk-averse and do nothing but play it safe, keeping their money in the bank

- People who turn the job of investing over to someone else, such as a financial advisor

- Gamblers

- Investors

Diversification is not a strategy for the wealthy

- It is an investment strategy for not losing, it is not an investment strategy for winning

- Successful and rich investors do not diversify, they focus their efforts

A true investor welcomes volatility because with it comes opportunity

- Investors know that bad economic times or markets offer them the best opportunities for future success

- “Get in when others are getting out”

A person who lives to be 75 should anticipate going through one depression and two major recessions

People who take risks change the world

- Few people ever get rich without taking risk

In the CF4, the left side is motivated by security and the right is motivated by freedom

Financial intelligence = how much money you keep, how hard that money works for you, and how many generations you keep it for

Your personal residence is not an asset, but instead a liability

- Anyone who thinks of their primary home as an asset likely lives on the left side of the CF4

- When a banker tells you your house is an asset they are not necessarily lying to you, they are just not telling you the whole truth

- Your asset is truly the bank asset, and you have to pay to own it

- An asset puts money in your pocket

- A liability takes it out

- Under this definition your house is more of a liability

- The value of your home is an opinion which fluctuates with the market, while your mortgage is a definite liability not affected by the market

In the banking industry an average mortgage is seven years

- Most people will continue to work hard, get pay raises, and buy bigger houses

The best way to avoid taxes legally is by generating income out of the B & I quadrants

Being educated in more than one quadrant is much better than just being knowledgeable in one

The average person earns 70 percent of their income from the left side and only 30 from the right, this is backwards if you want to be wealthy

True investors make the most money in bad markets

- A lot of investing depends on the buy

- Your profit is made when you buy…not when you sell, so excellent investors buy when mostly everyone else is selling

If you take on risk and debt, make sure you get paid for it

The only difference between a rich person and a poor person is what they do in their spare time

It is highly likely that any Bs will build two or three companies that fail before building a successful company that lasts

- Resilience and perseverance is often what separates those that succeed and those that don’t

Beware of the advice you take. While you must keep an open mind, always be aware of which quadrant the advice is coming from

What others think of you is none of your business, what is most important is what you think of yourself

Simply having a long term plan that reduces consumer debt while putting away money in an investment each month will give you a head start on retiring wealthy

The wealthy spend a small fortune on solid professional advice to increase and protect their wealth

A capitalist’s purpose is to make more money by synergistically orchestrating other people’s money , other people’s talent, and other people’s time

True capitalists create their wealth by using the talents and finances of others

True capitalists move forward while others are running away

The game of capitalism is who is indebted to whom

The more people you are indebted to, the poorer you are

Money is seen and created with your mind

It is what you cannot see that is important; it is the details of the deal- the financial agreement, the market, the management, the risk factors, the cash flow, tax exposure -. that make for a good investment

Most people invest 95% with their eyes and 5% with their mind

Buying emotionally instead of rationally

If money is not first in your head, it will not stick to your hands

Investing is not risky, being uneducated is risky

Often times, the non-wealthy will say things like “you can’t do that” or “it’s never been done before”

What they mean is they can’t do it, but if you truly want to be wealthy, you have to ignore this

Passion builds businesses. Not fear

Security is a myth…Learn something new and take on this brave new world. Don’t hide from it

People on the left pay to take risks and the people on the right side get paid to take risks

You do not have to go to school to become rich

People who work the hardest do not wind up rich

If you want to be rich, you need to “think”

Think independently rather than go along with the crowd, this is what separates those who become rich and those who do not

Greatest asset of the rich is that they think differently than everyone else

Moving from the left side to the right side of the CF4 is not so much doing as it is being

You must become an I and a B

People who take risks, make mistakes and recover often do better than people who learned not to make mistakes because they were afraid of the risk

Financial IQ is 90 percent emotional IQ and only 10 percent technical information

To be successful on the right side of the CF4 have to be emotionally neutral to winning and losing

Winning and losing are just part of the game

When issues arise tell yourself positive talk

- Keep calm

- Think clearly

- Keep an open mind

- Keep going

- Ask someone who has gone before you

Find others who have gone before to help guide you in decisions

When emotions and fear are high, it is easy for financial independence to disappear

True intelligence is knowing when to quit

An investment must make sense before any of the tax benefits

Any tax benefits only make the investment more attractive

There are two big choices, the choice of security and the choice of freedom

If you choose security, there is a huge price to pay for that security in the form of excessive taxes and punishing interest payments

If you choose freedom, then you need to understand the whole game and play the whole game

Action will always beat inaction

Maintain a long term vision

Believe in a delayed gratification

Use the power of compounding in your favor

The financial consultants at Arrow Point Wealth Management are registered representatives with and securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC

This material has been prepared for informational purposes only, and is not intended as specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.