The Most Important Thing – Howard Marks

Book Notes and Takeaways via Duncan Kelm

Experience is what you got when you didn’t get what you wanted

Financial theory should inform our decisions, but not dominate them

The two different schools of investing

- VALUE: Buy stocks, even those whose intrinsic value may show little growth in the future, out of conviction that the current value is high relative to the current market price

- GROWTH: Buy stocks, even those whose current value is low relative to current price, because they believe the value will grow fast enough in the future to produce substantial appreciation

- Thus the choice is really between value today and value tomorrow

- Growth investing represents a bet on company performance that may or may not materialize in the future, while value investing is based primarily on analysis of a company’s current worth

Buying value, you can’t ever expect immediate success, often times you will find that the price will continue to decline after you have purchased

Being too far ahead of your time is indistinguishable from being wrong

Investors with no knowledge of (or concern for) profits, dividends, valuation, or the conduct of business simply cannot possess the resolve needed to do the right thing at the right time.

- With everyone around them buying and making money, they can’t know when a stock is too high and therefore resist joining in. And with market in freefall, they can’t possibly have the confidence needed to hold or buy at severely reduced prices

“I pledge allegiance to short term volatility for long term growth” – this is how wealth is created in market investments

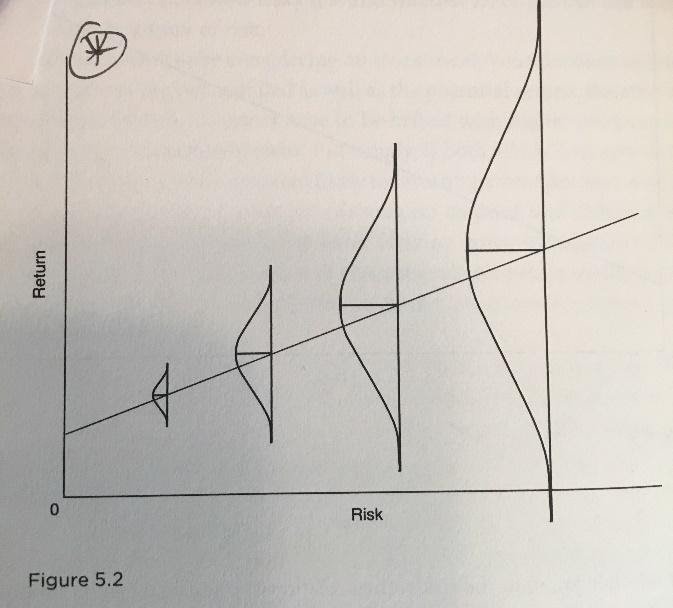

Risk:

- Risk is a bad thing, most level-headed people want to avoid or minimize risk

- Risk should be a function of the decision along with the potential return

- Return can ONLY be considered when factoring in risk

- The true graph of risk:

Volatility is not the risk most investors care about

You will never hear: “I won’t buy it because its price might show big fluctuations,” or “I won’t buy it because it might have a down quarter.”

Rather than volatility, people decline to make investments primarily because they are worried about a LOSS OF CAPITAL or an unacceptably low return

Other, more important key risk factors

- Falling short of one’s goals

- Dealing with this risk is an important piece of the service Arrow Point Wealth Management offers its clients

- Underperformance

- Can sometimes be eliminated by emulating the benchmark or index but can also increase underperformance in narrow trading markets (only a few sectors doing well and making up a larger % of the index)

- Career risk

- Risk that would potentially cause a financial manager to get fired would be rarely worth taking

- Unconventionality

- The risk of being different, it is always easier to go with the average, but then how do you distinguish yourself?

- Illiquidity

- The inability to access cash quickly is a risk that is always worth considering

The relation between different kinds of investment and the risk of loss is entirely too indefinite, and too variable with changing conditions, to permit of sound mathematical formulation – Ben Graham (mentor to Warren Buffett)

It is impossible to assess the accuracy of probability estimates other than 0 and 100 except over a very large number of trials

There is a big difference between probability and outcome. Probable things fail to happen-and improbable things happen-all the time

Here is the KEY TO UNDERSTANDING RISK:

- It is largely a matter of opinion. It is hard to be definitive about risk, even after the fact. You can see that one investor lost less than another in bad times and conclude that the investor took less risk. Is this statement necessarily accurate?

Risk exists only in the future and it is impossible to know for sure what the future holds…No ambiguity is evident when we view the past

Many things could have happened in each case in the past, and the fact that only one did happen understates the variability that existed

The point: PEOPLE USUALLY EXPECT THE FUTURE TO BE LIKE THE PAST AND UNDERESTIMATE THE POTENTIAL FOR CHANGE

People overestimate their ability to gauge risk and understand mechanisms they’ve never before seen in operation

Bearing higher risk generally produces higher returns. The market has to set things up to look like that’ll be the case; if it didn’t, people wouldn’t make risky investments

Risk means uncertainty about which outcome will occur and about the possibility of loss when the unfavorable ones do

Risk arises when markets go so high that that prices imply losses rather that the potential rewards they should

When people aren’t afraid of risk, they’ll accept risk without being compensated for doing so, and risk compensation will disappear

***KEY***: There are few things as risky as the widespread belief that there’s no risk, because it is only when investors are suitably risk averse that prospective returns will incorporate appropriate risk premiums

Risk CANNOT BE ELIMINATED, it can just be transferred and spread

The recent crisis occurred because investors partook in novel, complex and dangerous things, in greater amounts than ever before

IT IS ONLY WHEN THE TIDE GOES OUT THAT YOU FIND WHO’S BEEN SWIMMING NAKED – Warren Buffet

The ultimate irony lies in the fact that the reward for taking incremental risk shrinks as more people move to take it

The truth is, the herd is wrong about risk at least as often as it is about return

Broadly negative opinion can make it the least risky thing since all the optimism has been driven out of its price

When everyone believes something embodies no risk, they usually bid it up to the point where it’s enormously risky

Since there are usually more good years in the markets than bad years, and since it takes bad years for the value of risk control to become evident in reduced losses, the cost of risk control – in the form of return forgone can seem excessive

The prudent homeowners who carry insurance and feel good about having protection in place, sometimes regret paying for the insurance when there’s no fire

Risky assets can make for good investments if they are cheap enough

Fooled by Randomness:

- Reality is far more vicious than Russian roulette. First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands of chambers instead of six. After a few dozen tries, one forgets about the existence of a bullet, under a numbing false sense of security. Second, unlike a well-defined, precise game like Russian roulette, where the risks are visible to anyone capable of multiplying and dividing by six, one does not observe the barrel of reality. One is thus, capable of unwittingly playing Russian roulette and calling it by some alternative low risk name

The road to long term investment success runs through risk control more than through aggressiveness. Over a full career, most investor results will be determined more by how many losers they have and how bad they are, than by the greatness of their winners. Skillful risk control is the mark of a superior investor

Cyclical Rules:

- Rule number one, MOST THINGS are CYCLICAL

- Rule number two, some of the GREATEST OPPORTUNITIES FOR GAIN AND LOSS COME WHEN PEOPLE FORGET RULE NUMBER ONE

People are emotional and inconsistent

Concepts like precariousness are forgotten in optimistic times

The cyclical process: The Ups

- The economy moves into a period of prosperity

- Providers of capital thrive, increasing their capital base

- Because bad news is scarce, the risks entailed in lending and investing seem to have shrunk

- Risk averseness disappears

- Financial institutions move to expand their businesses-that is provide more capital

- They compete for market share by lowering demanded returns (cutting interest rates) lowering credit standards, and providing more capital for a given transaction and easing covenants

The cyclical process: The Downs

- Losses cause lenders to become discouraged and shy away

- Risk averseness rises, and along with it, interest rates, credit restrictions, and covenant requirements

- Less capital is made available and at the trough of the cycle goes to only the most qualified of borrowers

- Companies become starved for capital. Borrowers are unable to roll over their debts, leading to defaults and bankruptcies

Whenever the pendulum is near either extreme, it is inevitable that it will move back toward the midpoint sooner than later

- In fact, it is the movement toward an extreme itself that supplies the energy for the swing back

Reaping dependably high returns from risky investments is an oxymoron

- But there are times when this caveat is ignored – when people get too comfortable with risk and thus when prices of securities incorporate a premium for bearing risk that is inadequate for the risk present

Two main risks:

- The risks of losing money

- The risk of missing opportunity

CLIENTS MENTALITY: When things are going well and prices are high, investors rush to buy, forgetting all prudence. At the turn of the cycle, when prices have plummeted and chaos exists, assets are available at extreme bargains. Yet, the herd loses all willingness to bear risk and continues to sell. And this will always be so because human instincts DO NOT CHANGE

Stages of a bull market

- The first, a few forward-looking people begin to believe things will get better

- The second, when most investors realize improvement is actually taking place

- The third, when everyone concludes things will get better forever (THIS THIRD ONE IS KEY)

GREAT ADAGE: What the wise man does in the beginning, the fool does in the end

Just like the oscillation of cycles, we never know:

- How far the pendulum will swing in its arc

- What might cause the swing to stop and turn back

- When this reversal will occur

- How far it will then swing in the opposite direction

Those who believe that the pendulum will move in one direction forever – or reside at an extreme forever – eventually will lose huge sums of money

The first emotion that serves to undermine investors’ efforts is the desire for money, especially as it morphs into greed

Money may not be everyone’s goal for its own sake, but it is everyone’s unit of accounting

Greed:

- The combination of greed and optimism repeatedly leads people to pursue strategies they hope will produce high returns without high risk; pay elevated prices for securities that are in vogue; and hold things after they have become highly priced in hope there’s still some appreciation left. Afterwards, hindsight shows everyone what went wrong: that expectations were unrealistic and risks were ignored

It is amazing how easy it is for people to engage in disbelief

Nothing is easier than self-deceit. For what each man wishes, that he also believes is true

When we watch Peter Pan, we don’t want the person next to us to say “I can see the wires”

- While we know boys can’t fly, we don’t care; we’re just there for fun

The financial consultants at Arrow Point Wealth Management are registered representatives with and securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC

This material has been prepared for informational purposes only, and is not intended as specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.