Mastering the Market Cycle – Howard Marks

Book Notes and takeaways via Duncan Kelm

Desirable information must be knowable and important

- Unknowable: what investors want to know regarding the future

- Unimportant: what a tweet might mean for the long term market direction

Greatest way to optimize the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressive and defensive

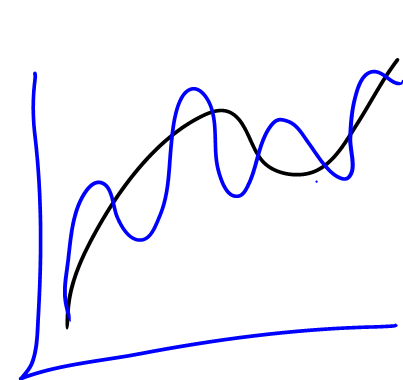

The future should never be viewed as a single fixed outcome that is capable of being predicted

- Instead it should be a range of possibilities

- More ideally in a representation of respective likelihoods through a probability distribution

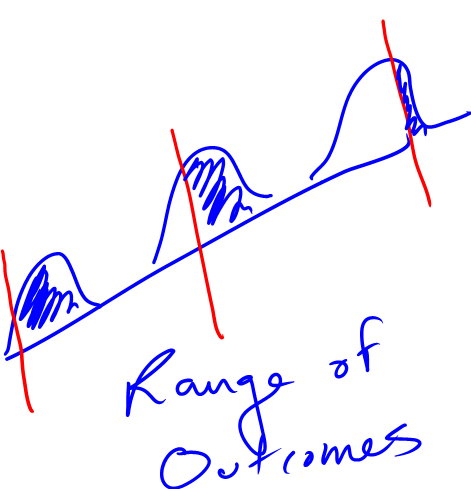

The potential for havoc increases as the movement away from the midpoint increases

- As economies and companies do very well the stock prices go too high

- As deep recessions appear, stock prices go way to too low

Some of the most important lessons concern…

- The need to study and remember events of the past

- Be conscious of the cyclical nature of things

Up close the blind man may mistake the elephants leg for a tree

- Likewise, shortsighted investors believe uptrends and downtrends will go on forever

The most important deviations from the general trend, and the variation in those deviations’ time, speed, and extent are largely produced by fluctuations in psychology

Cycles are inevitable

- Every once in a while an up or down-leg goes on for a long time and/or to a great extreme and people start to say “it is different this time”

- It is almost the case that the old rules apply

History does not repeat but it does rhyme

Booms usually won’t be followed by modest, gradual, painless adjustments

- We are unlikely to have a bust if we haven’t had a boom

- Thus an upward movement may be followed by a downward movement of either greater or lesser magnitude

- The downward turn may commence just after the apex is reached, or things may stay at a high for a long time before beginning to correct

We live in a world that is beset by randomness, therefore trying to create a “perfect formula” is arguably impossible

- People create this randomness because people are randon and do not behave the same from one instance to the next

To profit from betting against the current trend of human intuition is a difficult task

The human mind is built to identify for each event a definite cause

- This makes it hard for people to come to terms with randomness

First step to realizing success or failure can come from neither great skill nor great incompetence, but simply from fortuitous circumstances

Birth rate is one of the long term indicators of GDP, and positive growth rate tends to create the presumption that economic growth will be positive in the future

Another principle element in the GDP equation is productivity or the output produced by each hour of labor

- Rising productivity increases GDP and vice versa

Cycles are never perfect and can move up or down for longer or shorter periods of time

While the long term trends set the actual potential growth rate, the actual level of each year’s GDP will vary greatly relative to the trend line

The marginal propensity to consume is a known % over time: each additional dollar earned will create a percentage of earnings that will go to consumption

- But this propensity to spend income is variable in the short run, so consumption can vary

The wealth effect is a huge influencer of our cycles

- People feel wealthier and spend more when their houses and other assets appreciate

- If people and companies believe the future will be good, they’ll spend more and invest more

Inflation is a result of a strong upward movement of the economic cycle

- When demand for goods increases relative to the supply, there can be “demand-pull” inflation

- When inputs production such as labor and raw materials, often due to lack of supply, increase in price, there can be “cost-push” inflation

Example of why debt to equity matters

- Assume the capital structure of this company consists of $15,000 of debt, requiring annual interest payments of $1,500 and sssume that there is $15,000 of equity and the net income of the company is $3,000 annually.. In a year when there is a $1,000 decline in operating profits the net income declines from $1,500 ($3,000 operating profit before interest payments minus $1,500 interest) to $500 ($2,000 minus $1,500). In other words a 33% decline in operating profit ($3,000 to $2,000) causes this company’s net income to decline by 67% (from $1,500 to $500). The magnified impact of a decline in operating profit on the net income illustrates financial leverage at work

- This is a big reason why Frankenstein or zombie companies are extremely scary, and the Trillions of BBB rated debt that may be downgraded could cause big time financial impacts

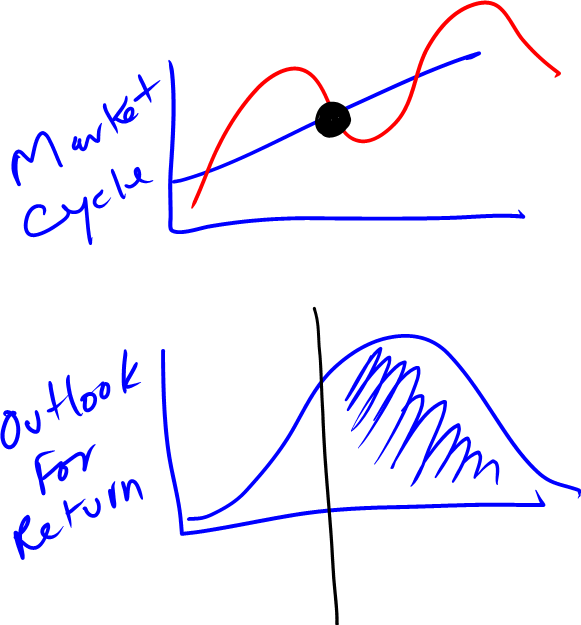

In business, financial and market cycles, most excesses on the upside and overvaluation – and the inevitable reactions to the downside, which tend to over exaggerate the negative – are a result of swings of the pendulum of psychology

VERY IMPORTANT INSIGHT -The movement toward an extreme itself supplies the energy to swing back

The too strong upward and downward swing result from psychological excesses in action

In the long run, stocks should provide returns in line with the sum of their dividends plus the trending growth of corporate profits

- When they return more than this for a while then the higher returns will likely prove to be transitory

- The swinging of a pendulum may be at a midpoint on average, but it actually spends very little time there

What is an empty building worth?

- Has replacement value

- Throws off no revenue

- Costs money in the form of taxes, insurance, maintenance, interest payments and opportunity cost

- Above scenario seems very negative, yet when the economy is cooking and the mood turns very positive. Then interest in the future potential of the building runs high, investors envision it full of tenants, throwing off vast amounts of cash, and thus saleable at a fancy price

- Today where we find ourselves with a lot of CA housing

The superior investor is mature, rational, analytical, objective, and unemotional

Investors tend to emphasize either positives or negatives rather than taking a balanced approach

Here is how investors react to events when they are feeling good about life:

- Strong data, economy strengthening – stocks rally

- Weak data, Fed likely to ease – stocks rally

- Data as expected, low volatility – stocks rally

- Banks make $4bn, business conditions favorable – stocks rally

- Banks lose $4bn, bad news out of the way – stocks rally

- Oil spikes, growing global economy – stocks rally

- Oil drops, more purchasing power for the consumer – stocks rally

- Dollar plunges, great for exporters – stocks rally

- Dollar strengthens, great for companies that buy from abroad – stocks rally

- Basically rosy optimists

When events are predominantly positive and psychology is rosy, negative developments tend to be overlooked

The rational investor is diligent, skeptical and appropriately risk-averse at all times, but also on the lookout for opportunities for potential return that more than compensates for risk

The linearity of which the relationship between risk and return is presented normally ignores the fact that for every level of risk there is a considerable range of potential outcomes

Investments which seem riskier have to appear to promise higher returns

The general scale of what people think of when they consider risk return

- Money market lowest return (~1.0%)

- 5-Year Treasury (~1.5%)

- 10-Year Treasury (~2.0%)

- High Grade Bond (~4.5%)

- S&P Stocks (~7.0%)

- High Yield Bonds (~8.0%)

- Small Stocks (~9.0%)

- Real Estate (~12.0%)

- Small Business/Private Investment (~18%)

- Venture Capital (~20%)

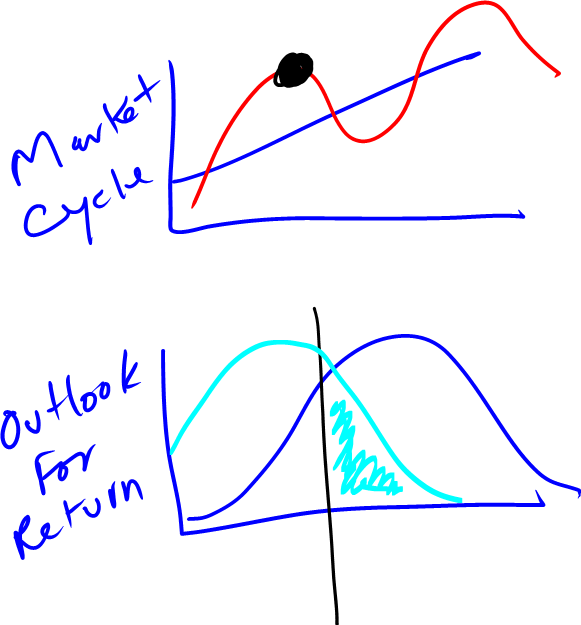

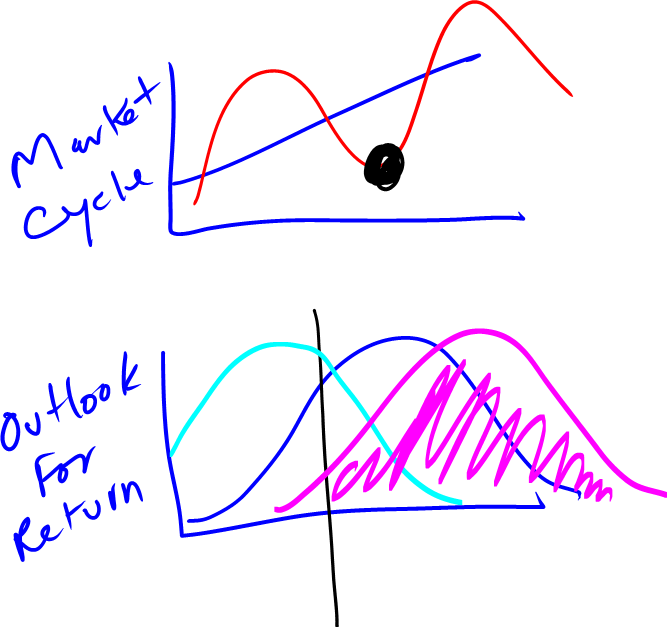

The general cycle of things

- Positive events lead to increased optimism

- Increased optimism makes people more risk-tolerant

- Increased risk tolerance causes lower risk premiums to be demanded

- A reduction of demanded risk premiums equates to lower demanded returns on risky assets

- A reduction of demanded returns on risky assets cause their prices to rise

- Higher prices make assets even riskier (but also attract buying on the part of the momentum investor)

- *In this scenario it follows that risk is high when investors feel risk is low*

When a big loss occurs

- Given their recent painful experience and the negativity they’ve developed about what lies ahead, they amp up their caution

- Since they now associate investing with loss rather than profit, their thinking leads them to emphasize the avoidance of further loss over prospecting for opportunity

- They assume that their decisions are conservative enough to rule out all potential for disappointment, and they apply extreme skepticism

- They find it impossible to identify – even to imagine – investments that offer an adequate margin of safety or any prospective return

- Since they see risk everywhere, they consider even the current swollen risk premiums insufficient

- They become worrywarts, in an opposite reaction to the events that led them to become buyers of overpriced assets at all-time highs, now their screaming risk aversion makes them sellers – certainly not buyers – at the bottom when the best opportunities exist to make money

Just as risk tolerance is unlimited at the top, it is non-existent at the bottom. The negativity causes prices to fall to levels from which losses are highly unlikely and gains could be enormous

The contributions to euphoria

- Extreme brevity of the financial memory

- When closely similar circumstances occur again, sometimes in only a few years, they are hailed by a new, often youthful, and always supremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world

- Adjust financial actions based on the investor behavior playing out around us

- The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs

If you refuse to fall into line in carefree markets like today’s, it’s likely that, for a while, you’ll lag in terms of return, look like an old fogey

- Neither of those are much of a price to pay if it means keeping your head when others eventually lose theirs

When others are panicked and depressed and can’t imagine conditions under which risk would be worth taking, we should turn aggressive

At bottoms it can be extremely hard to take actions that require conviction and staunchness

In a negative environment, negative risk aversion can cause people to subject investments to unreasonable scrutiny and endlessly negative assumptions where they may have performed little or no scrutiny in the good times

If you could only ask one question in regards to an investment , ask “How much optimism is factored into the price?”

Superior investing doesn’t come from buying high-quality assets, but from buying when the deal is good, the price is low, the potential return is substantial, and the risk is limited

- These conditions are much more the case when the credit markets are in the less-euphoric, more stringent part of the cycle

The credit cycle is the most volatile of the cycles and has the greatest impact

The credit market gives off signals that have great psychological impact

- A closed credit market causes fear to spread, even out of proportion to businesses’ negative realities

Ice cold markets in which no one’s eager to lend can create real winners

The degree of openness in the credit window depends almost entirely on whether providers of capital are eager or reticent, and it has profound impact on economies, companies, and investors, and the prospective return and riskiness of the investment opportunities that result

Everything else being equal, the bigger the boom – and the greater the excesses of the capital markets in the upward direction – the greater the bust

- The timing and extent are never predictable, but the occurrence of cycles is the closest thing to inevitable that exists

- Strong credit pullback likely, Zombie companies

Too much cheap money can result in over expansion and eventually dramatic losses

When making investments, worry less about the economic future – which you cannot know much about – and more about the supply/demand picture relating to capital

- Being positioned to make investments in an uncrowded arena conveys advantage

- Participating in a field everyone is throwing money into is a formula for disaster

2007/2008

- The existential cause was the too liberal attitudes towards financial risks

- Those carefree attitudes were inflamed by strong demand for high-yielding investments

- Those two factors led to an excessive willingness on the part of investors to accept innovative financial products and to swallow whole the favorable extrapolation on which those products were based

- The predominance of mortgage backed securities in that era gave rise to a rapidly increasing need for mortgages from which to fashion new securities

- That demand facilitated the selling onward of mortgages which in turn allowed mortgage lenders to be careless in choosing the prospective home buyers to whom they would lend. They wouldn’t suffer financial harm if the mortgages defaulted, so who cared?

- Relaxed credit diligence on the part of mortgage lenders, and the availability to home buyers of generous sub-prime financing, made home ownership possible for more Americans

- Seduced by potential profits from conducting ratings, the rating agencies competed for business by offering inflated ratings, in a race to the bottom on their own

- Home affordability increased substantially, fueled by the fact that interest rates are low on short maturities

- Investment banks were eager to turn the raw material of plentiful sub-prime mortgages into tranched mortgage backed securities with the highest average credit rating

The events which provided the basis for the GFC were almost all about money

- The pursuit of money took a powerful upswing

- The economic realities that reflect on and constrain the attainment of money were often ignored

- The caution and risk aversion that usually bear on the willingness of the market participants to provide money were largely absent

- The capital cycle rose to an irrational extreme, the consequences of which are generally foreseeable

When negative psychology is universal and “things can’t get any worse” they won’t

- When all optimism has been driven out, and panicked risk aversion is everywhere it becomes possible to reach a point where prices can’t go any lower

- When prices eventually stop going down, people tend to feel relief

- And so the potential for a price recovery begins

2007/2008 was the first debt induced panic with ramifications for the entire economy

When a downturn comes those who possess capital and are willing to part with it can apply rigorous standards, insist on strong loan structures and protective covenants, and demand high prospective returns

Superior investing does not come from buying high-quality assets, but from buying when the deal is good, the price is low, the potential for return is substantial, and the risk is limited

When credit tightens and debt markets start to struggle

- A slower economy makes it harder for companies to service their debt

- With the credit market closed, refinancing can’t be accomplished

- Rising defaults damage investors psychology

- Investors who were risk-tolerant when things were going well now become risk-averse

- Advancing capital to financially distressed companies – which seemed like a good idea just a short time earlier- now goes out of favor

- Potential debt buyers back away

- Capital that is mobile flees from the market

- Selling of bonds increases

Real estate comments

- They are not making any more – connection to land

- You can always live in it – connection to housing

- It’s a hedge against inflation – all types of properties

- *What people eventually learn is that regardless of the merit behind these statements, they won’t protect an investment that was made at too high a price*

Real estate is a virtuous cycle which takes on the appearance of being unstoppable, and this appearance causes asset prices and the level of activity to go too far to be sustained

- West Coast real estate

Real estate incorporates an ingredient which others cycles do not, the long lead times required for real estate development to take place

- Environmental impact studies

- Permission to build

- Zoning modifications

- Financing needs to be obtained

- Construction has to be completed

In lending, since the time lags inherent in the process are brief, the economic and business conditions in force at the time that will tend to arise and the loan is conceived generally are still in force when the loan is funded

- If conditions change in the relative interim the banks own the risk

Following the GDC it was clear that the supply of new homes in the years immediately following clearly would be insufficient to meet a pickup in demand for homes

Certain words and phrases must be excluded from the intelligent investor’s vocabulary

- Never

- Always

- Forever

- Can’t

- Won’t

- Will

- Has to

Statements made about the average home sold in a given year don’t necessarily say anything about the price performance of a given home or of all homes standing

- There is no adjustment for physical changes in the average house over time, or in the mid of homes sold that year relative to all homes

Looking at the Herengracht data you can see that there are 50 year trends in housing and then they can turn around

Always be skeptical of those who claim that property values can continue to increase ad infinitum

It has only been in the recent decades that huge increases in real estate prices have become the norm and that people have come to expect them according to Robert Shiller

In times of rising asset prices, people turn bullish and commentators provide authoritative support

For real support, look to commentators who issue sober statements in bullish times, or who argue against negativity when markets are down

- Marks, Bernstein, Gallea

Real estate is subject to ups and downs like all others, but it also has special amplified factors

- The time lags between conception and readiness for sale

- The extremely high financial leverage that is typical

- The fact that the supply is generally too inflexible to be adjusted as demand fluctuates

Rising prices make investors feel wealthier, smarter, and more optimistic

- Wealth effect when houses are booming

The thing at which things play out is highly variable from cycle to cycle and over the course of given cycle

Investor rationality is the exception not the rule

- The market spends little of its time calmly weighing financial data and setting prices free of emotionality

Three stages of a bull market

- First, when only a few unusually perceptive people believe things will get better

- Second, when most investors realize that improvement is actually taking place

- Third, when everyone concludes things will get better forever

What the wise man does in the beginning, the fool does in the end

Most investors capitulate eventually, they simply run out of the resolve needed to hold out

Not every big rise is a bubble

Whenever people are willing to invest regardless of price they’re obviously doing so based on emotion and popularity rather than cold-blooded analysis

No asset or company is so good that it can’t become overpriced

“Price doesn’t matter” is a necessary component – and a hallmark – of a bubble

The most important thing to note is that maximum psychology, maximum availability of credit, maximum price, minimum potential return and maximum risk all are reached at the same time, and usually these extremes coincide with the last paroxysm of buying

Play the probabilities within the cycles

Where we stand in a cycle influences the tendencies of probabilities, even if it does not determine future developments with certainty

Two key questions

- How are things priced

- How are investors behaving

Markets are driven by fear and greed

- Sometimes the biggest motivator is fear of missing out

Forecasting does not work

- Very few people can know enough about what the future holds for it to add to their return, and the record of most forecasters in terms of predicting events better than others, is quite lackluster

The key to being able to behave in a way that’s appropriate given the market climate lies significantly in assessing psychology and the behavior of others

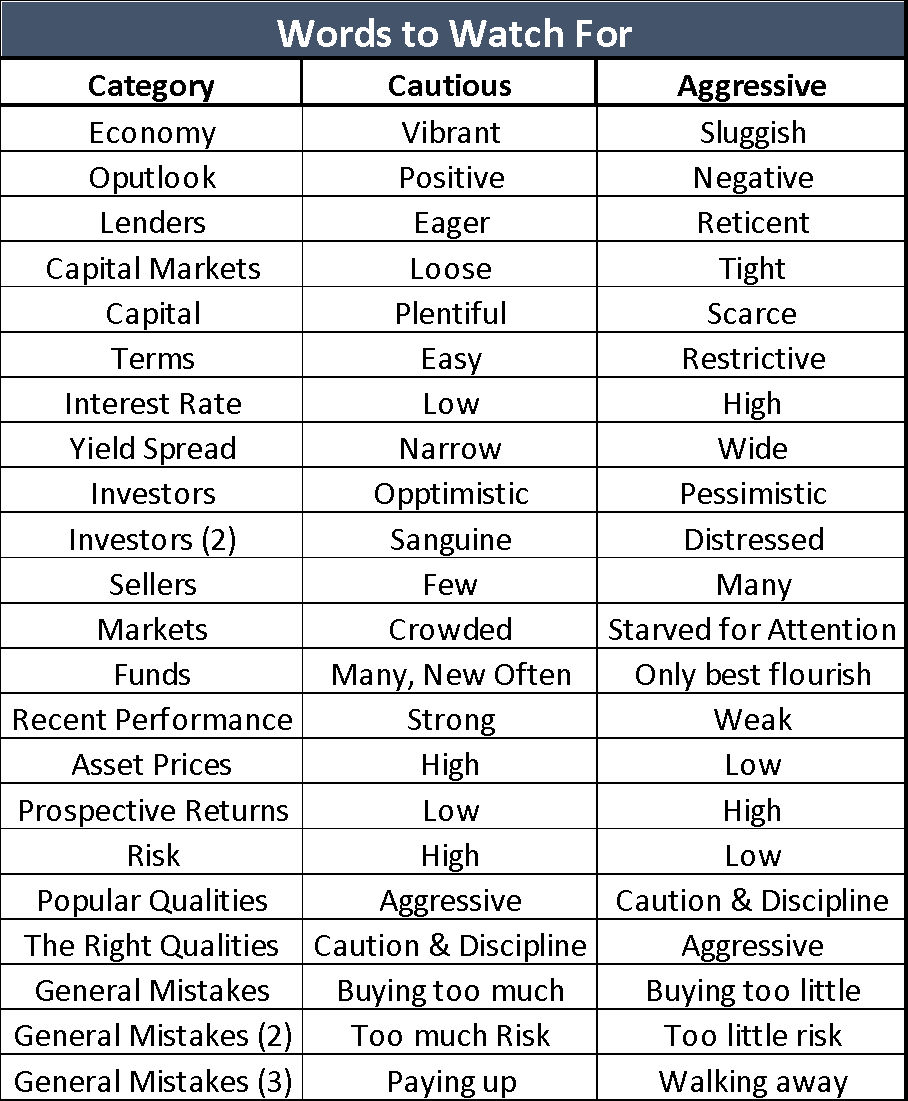

These are what you should watch out for, left is time to be cautious, right is time to be aggressive – page 212/213

To be an above average investor all you have to do is be able to spot “nutty” behavior when you see it

People are scared of buying a decline before it has stopped, and thus looking bad, so they will wait until the bottom has been reached, the dust settled, and the uncertainty has been resolved

For people that did not sell in 2007/2008 there were people who had recouped their investment before the end of 2009

- Resilience and resolve is critical at peaks of emotion

Investment success consists of six components

- Cycle positioning; deciding on the risk posture of your portfolio

- Asset selection; which markets, market niches, and individual assets to overweight or underweight

- Aggressiveness; Risking more of your capital

- Defensiveness; investing less capital and holding cash instead

- Skill; the ability to make these decisions correctly on balance

- Luck; what happens when skill and reasonable assumptions prove to be of no avail

While you can always be unlucky regarding the relationship between what logically should happen and what actually does happen, good positioning decisions can increase the chance that the market’s tendency – and thus the chance for outperformance – will be on your side

Investing consists of positioning capital so as to benefit from future events

The financial consultants at Arrow Point Wealth Management are registered representatives with and securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC

This material has been prepared for informational purposes only, and is not intended as specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.